1. FPIs inflow hit 10 months high of Rs 12260 cr in November

• Overseas investors have pumped 12,260 crore rupees into the Indian capital markets last month.

• It was the highest inflow in 10 months due to falling crude oil prices and sharp rupee appreciation.

• In January this year, foreign portfolio investors, FPIs, had put in 22,240 crore rupees in the capital markets.

• According to the latest depository data, FPIs invested a net sum of 6,913 crore rupees in equities last month and over 5,340 crore rupees in the debt market.

2. Rs 60000 crore to be spent on MGNREGA this year: Finance Minister

• Finance Minister Arun Jaitley, about 60 thousand crore rupees would be spent on Mahatma Gandhi National Rural Employment Guarantee Act, MGNREGA this year.

• Government has pumped in resources into the rural areas which has improved the infrastructure and the quality of life of people.

• If this level of investment with its annual increase is continued for at least the next two decades, India will be close to providing a quality of life and infrastructure which is more like urban areas.

• The Finance Minister said, the investment in rural roads has increased three-fold and very soon India will be close to the destination of connecting every village with a pucca road.

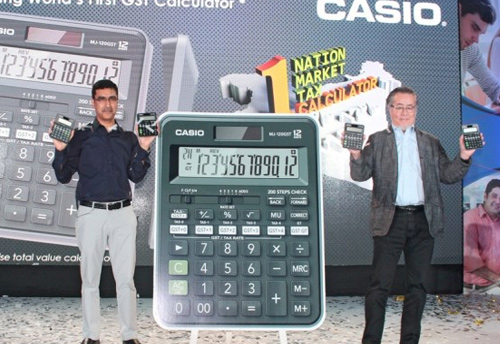

3. Casio launches world’s first GST calculator

• Japanese electronics company ‘CASIO’ has launched world’s first Goods and Services Tax (GST) calculator in India for simplify the GST calculations for tax payers.

• Japanese electronics company ‘CASIO’ has launched world’s first Goods and Services Tax (GST) calculator in India for simplify the GST calculations for tax payers.

• The company has two variants of GST calculators MJ-120GST and MJ-12GST in the Indian market.

• These new GST calculators will provide solution for GST based invoicing.

• These GST calculators feature built-in GST tabs for all five tabs- 0%, 5%, 12%, 18% and 28%.

• It includes separate buttons for GST slabs to reduce time required for processing invoice.

4. Estimates of Gross Domestic Product for the Second Quarter (July-September) of 2018-19

• The Central Statistics Office (CSO), Ministry of Statistics and Programme Implementation has released the estimates of Gross Domestic Product(GDP)for thesecond quarter (July-September) Q2 of 2018-19, both at Constant(2011-12) and Current Prices, along with the corresponding quarterly estimates of expenditure components of the GDP.

• GDP at Constant (2011-12) Prices in Q2 of 2018-19 is estimated at `33.98 lakh crore, as against `31.72lakh crore in Q2 of 2017-18, showing a growth rate of 7.1 percent.

• Quarterly GVA (Basic Price) at Constant (2011-2012) Prices for Q2 of 2018-19 is estimated at `31.40 lakh crore, as against `29.38lakh crore in Q2 of 2017-18, showing a growth rate of 6.9 percent over the corresponding quarter of previous year.

• The Economic Activities which registered growth of over 7 percent in Q2 of 2018-19 over Q2 of 2017-18 are ‘Manufacturing, ‘Electricity, Gas, Water Supply & Other Utility Services’‘Construction’ and‘Public Administration, Defence and Other Services’.

• The growth in the ‘Agriculture, Forestry and Fishing’, ‘Mining and Quarrying’, ‘Trade, Hotels, Transport, Communication and Services related to Broadcasting’ and Financial, Real Estate and Professional Services is estimated to be 3.8 percent, (-) 2.4 percent, 6.8 percent, and 6.3 percent respectively during this period.

• The Second Quarter Data for the GDP growth for the Financial Year (FY) 2018-19 has been released today. The Ministry of Finance makes the following Statement in this regard.

• The Second Quarter has seen a reasonable overall GDP growth of 7.1%. The H-1 2018-19 growth of the GDP is 7.6% and the H-1 GVA growth is 7.4%. The growth in the Second Quarter is on higher base compared to the growth of the First Quarter.

• The Manufacturing Growth on a base of 7.1% in Q2 2017-18 has been 7.4% in Q2 2018-19. The Construction Sector has grown by 7.8%. This Quarter also faced the challenge of higher oil prices resulting in much higher import bill and the weakening of the rupee. The Indian Economy is on track to maintain a high growth rate in the current global environment, the Ministry concluded.

5. RBI keeps all key policy rates unchanged

• The Reserve Bank of India maintained status quo on all key policy rates in the fifth bi-monthly monetary policy review. Subsequently, the repo rate remains unchanged at 6.5 percent and the reverse repo rate at 6.25 percent.

• Repo rate is the rate at which RBI lends to banks generally against government securities. The reverse repo is the rate at which RBI borrows money from banks.

• The RBI informed the marginal standing facility rate and the Bank Rate too remain at 6.75 percent.

• The six-member monetary policy committee headed by RBI Governor Urjit Patel unanimously voted to maintain the status quo on policy rates.

• In the last policy announced in October, RBI had kept all the policy rates unchanged.

6. Exim Bank extends USD 500 mn loan to Tanzania

• Export-Import Bank of India (Exim Bank) has extended a credit facility of USD 500 million to Tanzania for water supply projects in the country.

• Exim Bank signed an agreement on May 10, 2018, with the Tanzania government for making available a Government of India-supported line of credit of USD 500 million for the purpose of financing water supply schemes.

• Under this agreement, of the total credit by Exim Bank, goods and services of value of at least 75 per cent of the contract price shall be supplied by the seller from India.

• The remaining 25 per cent of goods and services may be procured by the seller for the purpose of the eligible contract from outside India.

######